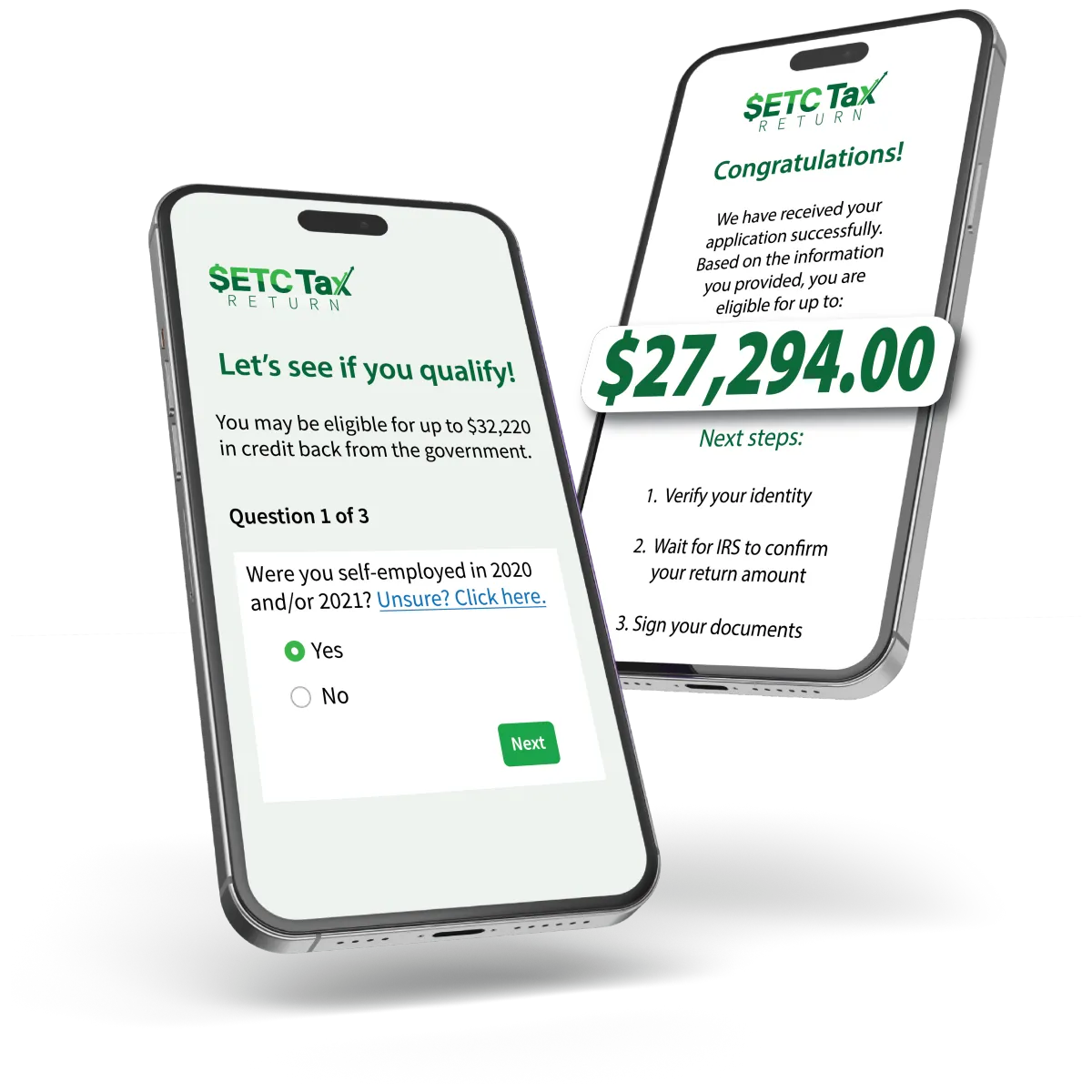

We help Self-Employed workers get up to $32,220 in SETC Tax Credits

Free Eligibility In 5 Minutes

Over 40 Million People Qualify

No Document Uploads

What is the Self Employed Tax Credit?

Self-Employed individuals can receive up to $32,220 in tax credit for missed work due to COVID

Applies to 1099 Contractors, Small Business Owners,Sole Proprietors, Freelancers, and Gig-Workers

These credits are NOT a loan or grant, but simply a refund from taxes you already paid in 2020 and 2021

$50B allocated to SETC - deadline for 2020 is May 17th, 2024 so ACT NOW to claim your refund

Unsure If You Qualify?

Self-Employed or 1099 Contractor

Unable to Work Due to COVID-19

Filed Schedule SE in 2020 or 2021

Are you Eligible?

How Do I Know if I Was Self-Employed? In 2020 or 2021 Did You Work as a:

How Does It Work?

Apply for Refund

Fill out an application to see if you qualify in less than 5 minutes.

Verify Identity

We verify your identity and confirm your eligibility.

Calculate Refund

We calculate your exact refund amount and send you documents.

Sign & Ship

Sign the documents and ship them back with prepaid label we provide.

Collect Refund

The IRS will mail your refund check directly to your home.

Benefits

Quick & Easy Process

Our state-of-the-art fully automated process simplifies your experience. Just fill out the questionnaire, and forget the hassle of gathering documents or chasing down your CPA.

Continuous Support

We have 24/7 customer support available to answer any questions or concerns you have. You can call, text or email us at any time.

100% Transparency

Our custom-designed dashboard offers real-time updates at every step of the process. We also send alerts through text and email to keep you informed.

Our Client Testimonials

"I never imagined I could receive such a significant tax credit until I discovered the benefits of the self-employed tax credit. It allowed me to get over $15,000 back from 2021 because of COVID, providing much-needed financial relief for my small business.

"Claiming $14,000 through the self-employed tax credit was a welcome surprise for my small business. It's reassuring to know that the government recognizes and rewards the contributions of self-employed individuals.

"II received $27,349 This extra influx of cash has enabled me to invest in marketing initiatives and reach new clients, driving growth and sustainability for my business."

Why Work With Us

Quick & Easy Process

Our state-of-the-art fully automated process simplifies your experience. Just fill out the questionnaire, and forget the hassle of gathering documents or chasing down your CPA.

Quick & Easy Process

We have 24/7 customer support available to answer any questions or concerns you have. You can call, text or email us at any time.

Quick & Easy Process

Our custom-designed dashboard offers real-time updates at every step of the process.We also send alerts through text and email to keep you informed.

Still Have Questions?

Watch the video below to Learn More

FAQs

What is the employment tax credit?

The self-employed tax credit was created under the Family First Coronavirus Response Act (FFCRA) and extended by the American Rescue Plan Act (ARP). It is a financial aid program for self-employed individuals, freelancers, and independent contractors. This credit aims to compensate those who experienced a loss of income due to COVID-19 related reasons.

How is the credit calculated?

The SETC credit is calculated based on the number of days you couldn't work due to COVID-19 and your net earnings from self-employment (From your schedule C or schedule SE). You get a daily amount for up to 10 days if you were sick or quarantined, and for up to 50 or 60 days for caring for someone else or due to school closures, depending on the year. Your daily earnings are determined by dividing your annual net self-employment income by 260 days.

What years can I apply for the credit?

You can apply for the self-employed tax credit for the tax years 2020 and 2021. You can use your 2019 net earnings if they're higher than those from 2020 to maximize your credit.

How do I receive my tax credit?

You'll receive your credit directly from the IRS in the form of a check mailed to your home. The processing time can vary, typically ranging between 16 to 20 weeks from the time of your application submission.

Can I receive if I was a W2 employee and self employed?

Yes, if you were both a W2 employee and self-employed, you can still qualify for the tax credit, as long as your self-employed work meets the SETC program's eligibility criteria. However, if you already claimed your full sick and family leave as a W2 employee, you may not be eligible to receive more.